BlackOlymp DAO Token

Friends and Family • TGE 1 and TGE 2 • June to July 2025

Friends and Family • TGE 1 and TGE 2 • June to July 2025

To launch regulated crowdfunding and digital assets as a public company

Ask ChatGPTBe part of this new adventure and get your DAO token

10 Mio DAO Token, fixed supply, ownership revoked

The participation for TGE 1 and 2 is on invitation only.

No token possession before the 366-day lock expires means no transferability and full regulatory clarity.

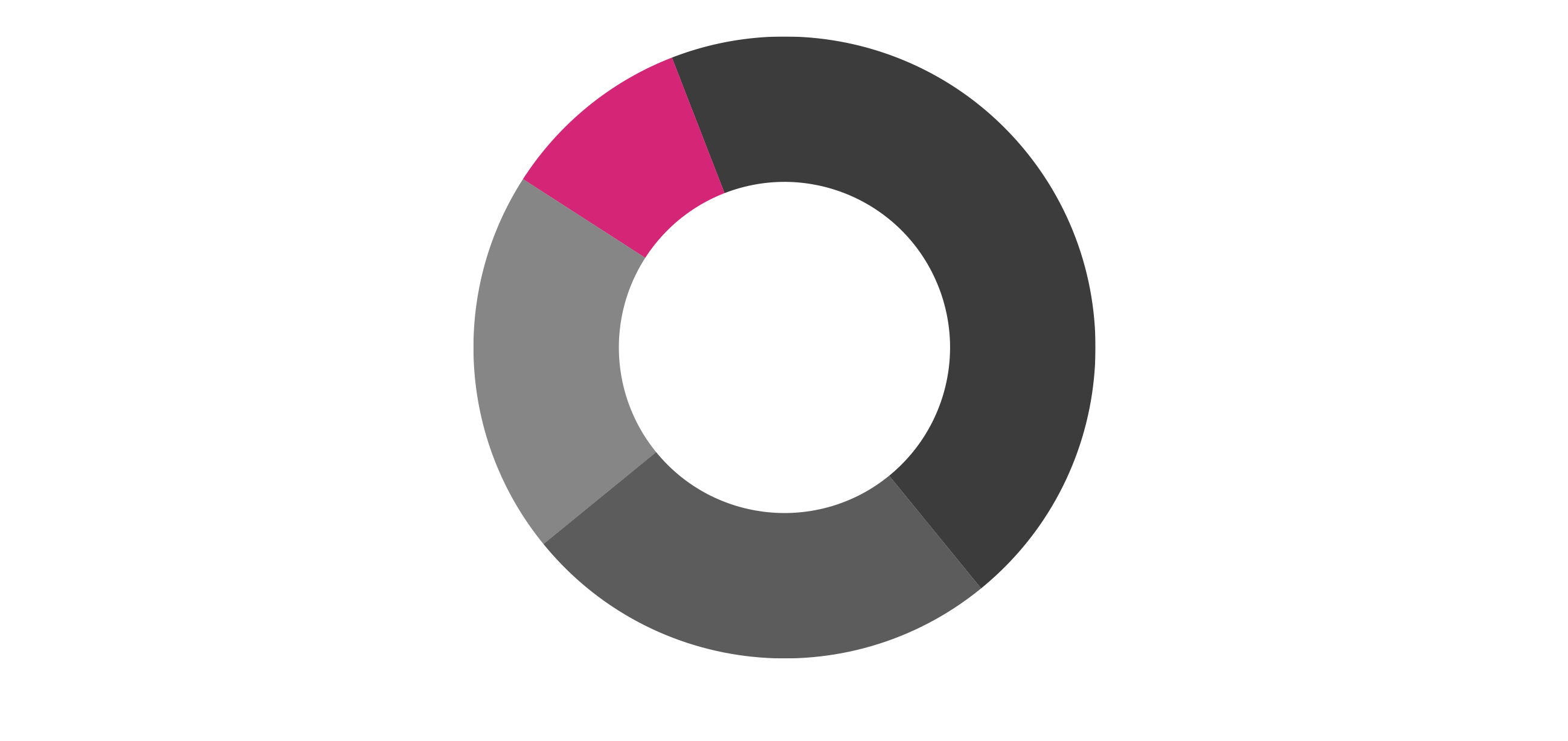

Use of Funds

Purpose of TGE Funds

Proceeds from TGE 1 and TGE 2 are pooled into a regulated gold and silver depot. These assets secure a collateralised credit line to finance the setup of a Liechtenstein-based DAO Foundation (Stiftung), fully governed by DAO token holders. The Stiftung will hold later up to 10 percent of the shares of BlackOlymp AG. The credit facility also covers regulatory licensing and infrastructure development for the AG.

Gold-Silver Depot

Physically backed, dynamically managed

100% of funds from TGE 1 and TGE 2 are secured in physical gold and silver, professionally held in a precious metals depot, Germany, a certified, award winning, and audited precious metals provider.

All assets are physically allocated, LBMA-certified, and stored under individual legal ownership in a regulated, audited depot. A strategic gold-silver ratio mechanism ensures dynamic reallocation between metals, enhancing liquidity and preserving value over time. This structure allows us to use the metal reserve as collateral for a credit facility, which enables the funding of BlackOlymp AG and future project structures without asset dilution or early token sales.

Gold-Silver Depot

Physically backed, dynamically managed

100% of funds from TGE 1 and TGE 2 are used to acquire LBMA-certified physical gold and silver, held under direct legal ownership by a Liechtenstein-based trust. The metals are stored in a professionally operated, audited precious metals depot managed by a regulated and award-winning German provider.*

All assets are physically allocated, LBMA-certified, and stored under individual legal ownership in a regulated, audited depot. A strategic gold-silver ratio mechanism ensures dynamic reallocation between metals, enhancing liquidity and preserving value over time. This structure allows us to use the metal reserve as collateral for a credit facility, which enables the funding of BlackOlymp AG and future project structures without asset dilution or early token sales.

* Disclaimer: The precious metals dealer is not a party to this private offering and assumes no role in the issuance, sale, or management of DAO tokens. They acts solely as the independent custodian and logistics provider for the physical assets held on behalf of the trust.

Specification

DAO direct ownership as the organisation

The proceeds from the DAO Token Generation Events (TGE 1 and TGE 2) are allocated exclusively to the acquisition of LBMA-certified physical gold and silver. All metals are individually allocated to, and legally owned by, the Liechtenstein-based trust acting for the benefit of DAO token holders. Ownership is evidenced by bar-specific serial numbers and regularly verified through external audits. The German precious metals provider acts solely as the vaulting and logistics agent and has no legal or beneficial claim to the stored assets. The metals are not held on the provider’s balance sheet, nor commingled with third-party holdings.

Milestones

Our Roadmap

Our roadmap reflects technical execution, legal structuring, and phased deployment—designed for long-term credibility, not quick hype.

Disclaimer

Before you Apply

This page and its contents do not constitute investment advice, an offer to invest, or a solicitation to acquire any financial instrument. Participation in the BlackOlymp DAO is not a public offering and is subject to eligibility checks, including manual KYC and AML verification.This offering is not available to U.S. citizens or residents of the United States. Each prospective participant is responsible for determining whether they are permitted to engage with the DAO in accordance with the laws of their home jurisdiction. We strongly recommend consulting a qualified legal or financial advisor before participating.All activities are conducted under private placement rules and subject to manual compliance screening.